what does cares act do

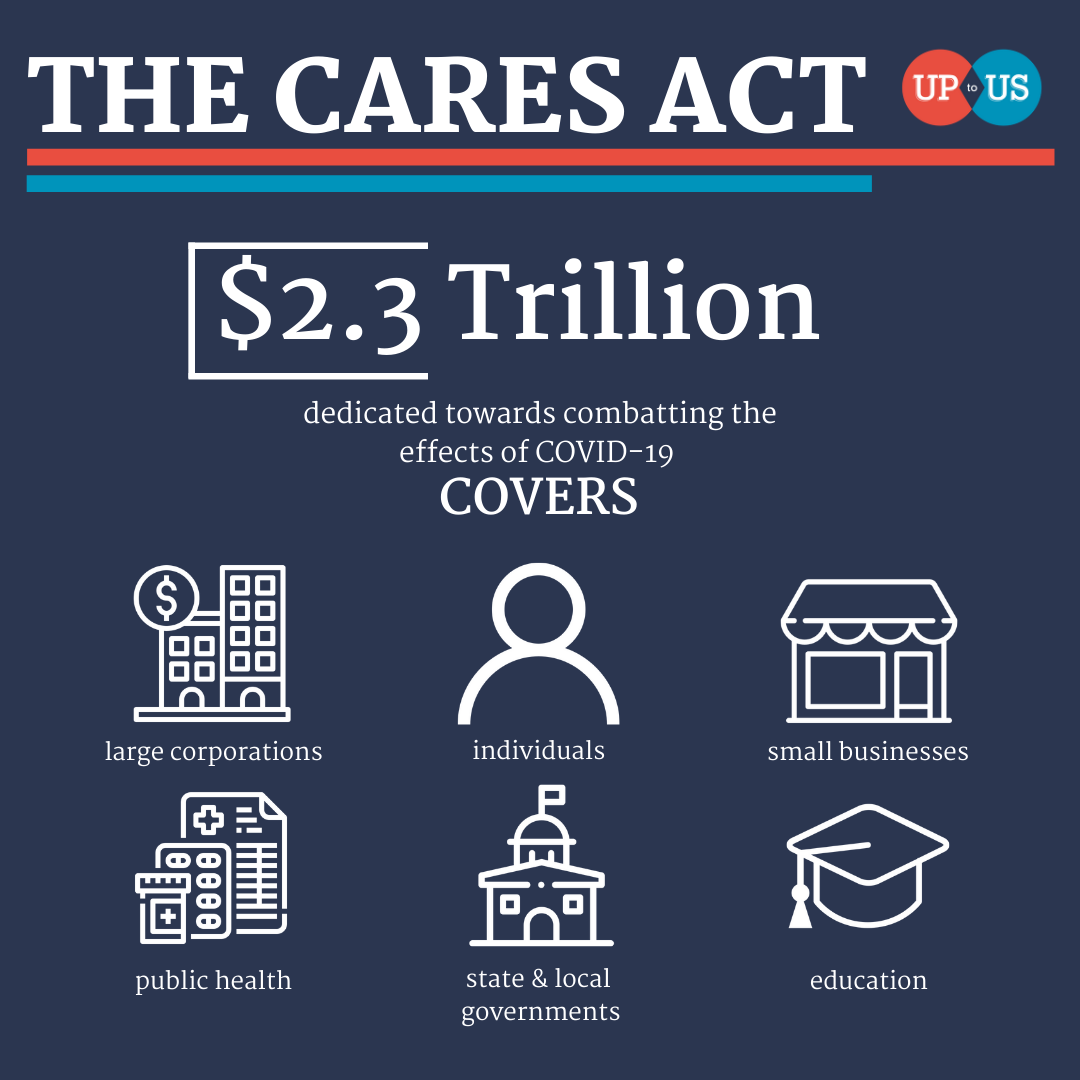

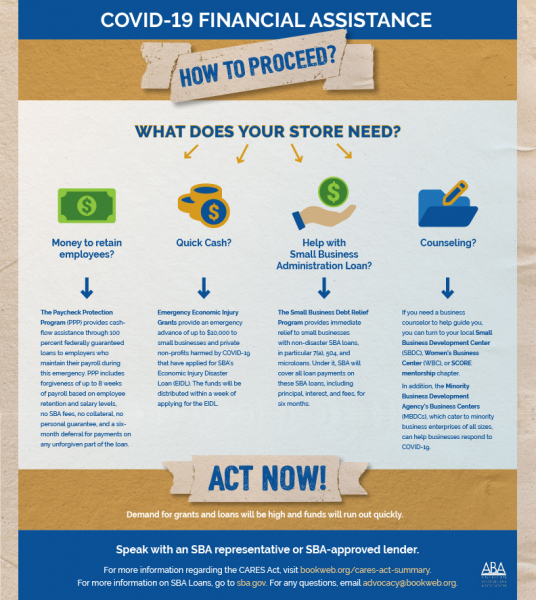

The CARES Act temporarily suspends certain government oversight laws. Its components include stimulus payments to individuals expanded unemployment coverage and more.

What Does The Affordable Care Act Do

Read more about CARES act 401k withdrawal.

. What does the CARES Act Do. This includes the requirement that the Federal Reserve Board hold meetings that are open to the. 4022 and 4023 provide the forbearance of payments from all borrowers of a Federally backed mortgage.

The law addresses health insurance coverage health care costs and preventive care. This help ranged from paycheck protection to unemployment aid to tax breaks for companies. If you repay some of that distribution back or all of it the IRS will.

The CARES Act passed in 2020 had aid for families and businesses. The CARES Act suspends Medicare sequestrationthe current across-the-board annual 2 percent reduction in Medicare paymentsfrom May 1 2020 to December 31 2020. However the program has since been extended to March 31 2021 and more recently extended.

The latter generally requires that employees have been employed for at least 30. The Infrastructure Act terminated the employee retention credit for wages paid in the fourth quarter of 2021 for employers that are not recovery startup businesses. As soon as everything began shutting down in an effort to slow the spread of COVID-19 the economy started to take a big hit.

The Care Act helps to improve peoples independence and wellbeing. The CARES Act addresses the rights of rehired employees to paid family leave under the FFRCA. The CARES Act also gave landlords any mortgagee really a break too.

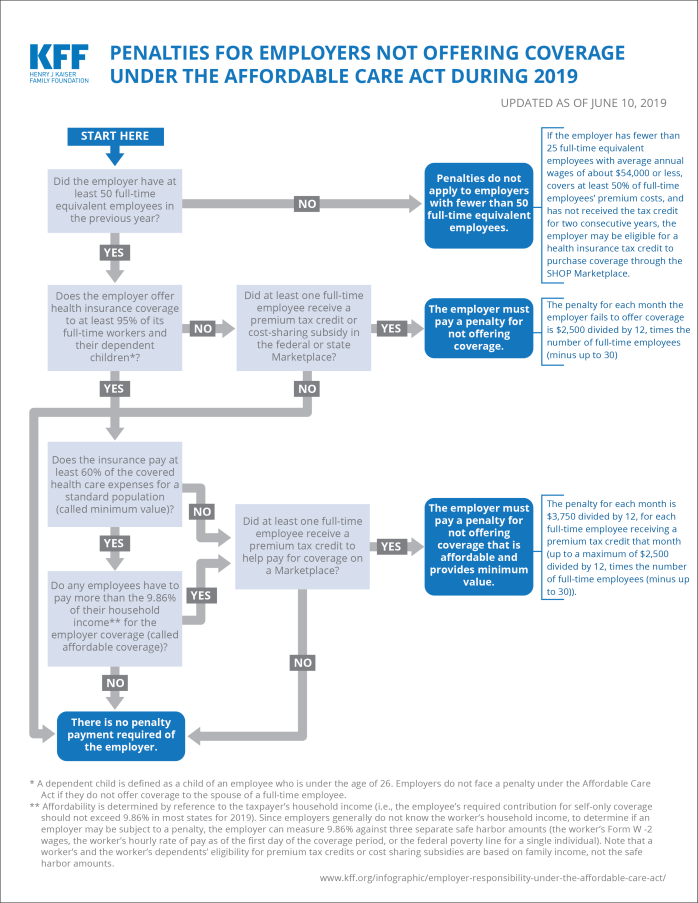

The Patient Protection and Affordable Care Act was signed. The Affordable Care Act ACA requires large employers those with 50 or more full-time employees to offer a health care plan that meets minimum value and affordability. The CARES Act does provide PUA to an individual who is the primary caregiver of a child who is at home due to a forced school closure that directly results from the COVID-19.

1 2021 and in the case of a taxable year beginning after Dec. The Coronavirus Aid Relief and Economic Security Act or CARES Act for short provides financial relief to American households through the Economic Impact Payments. The law was enacted in two parts.

The CARES Act retroactively eliminates the 80 percent limitation for taxable years beginning before Jan. It makes clear that local authorities must provide or arrange services that help prevent people developing needs for care. The COVID-19 economic relief thru the CARES act 401k withdrawal allows families to take advantage of their retirement savings.

Second the CARES Act provides funds to federal agencies in order to reimburse federal contractors for paid leave that they provided to certain employees or subcontractors. The act consists of separate titles having significant aims. What Is the CARES Act.

The CARES Act initially set forbearance protection to expire on Dec. Under the CARES act you are allowed to spread out your income tax liability over the course of three years. So President Trump signed.

To achieve universal health coverage through shared responsibility among the individuals and government. The bill provides federal aid to.

The Cares Act A Simple Summary Bench Accounting

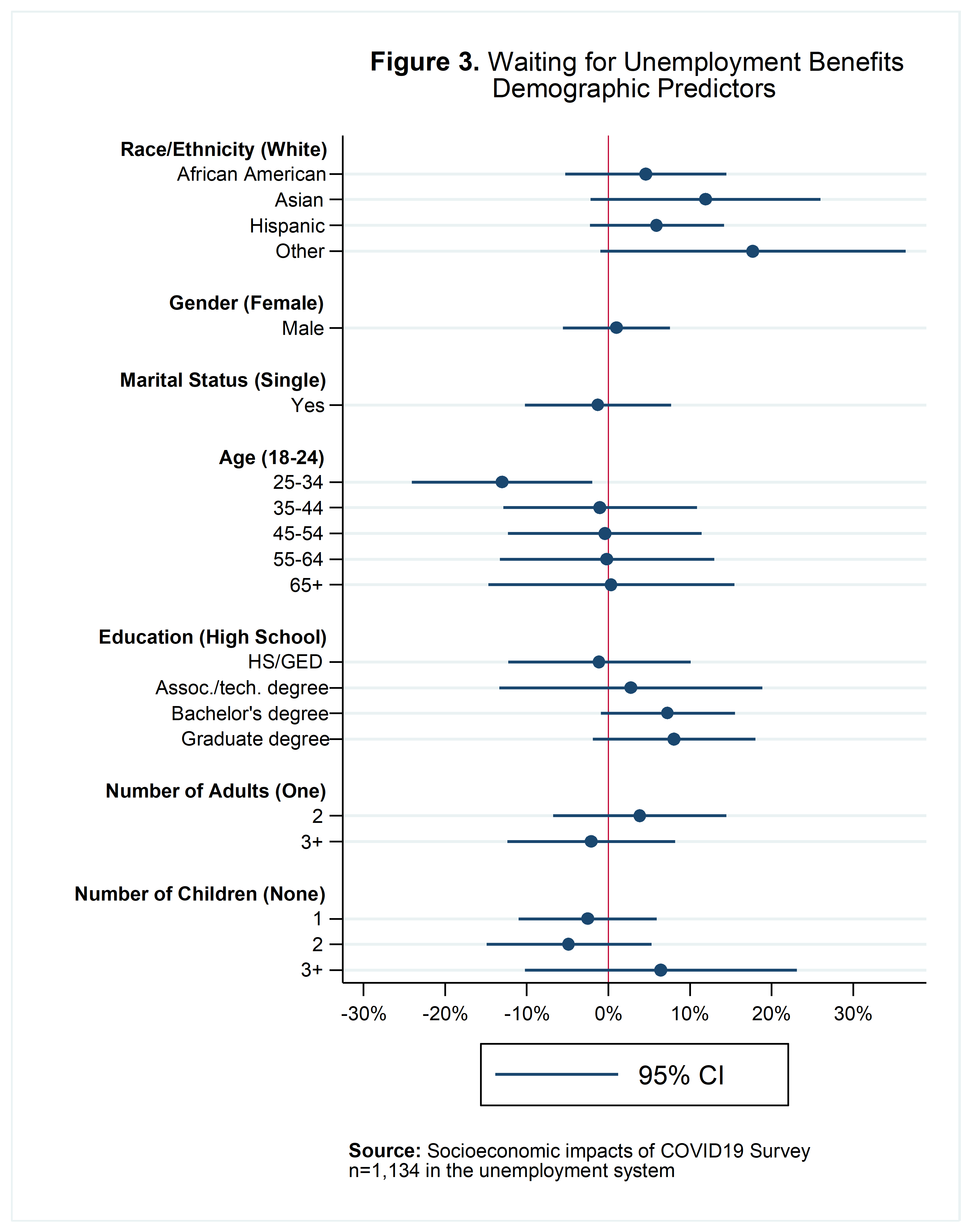

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

Top 10 Cares Act Provisions You Need To Know About

Visual Breakdown Of The Cares Act And Its Economic Impact Uptous

Cares Act 2021 Tax Incentives Aopa

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

What Does The Cares Act Mean For Me Covid 19 Medsphere

Cares Act H R 748 Representative Michael San Nicolas

Employer Responsibility Under The Affordable Care Act 2019 Kff

Avoid Foreclosure Illegal Mortgage Fees Bad Credit Covid Phillips Garcia P C

What Does The Cares Act Mean For Hospitals And Health Systems Op Ed

Cares Act Covid 19 Stimulus Summary Wineamerica

Cares Act Summary The American Booksellers Association

Podcast Series What Does The Cares Act Mean For You Jnba Financial Advisors