does nevada tax your retirement

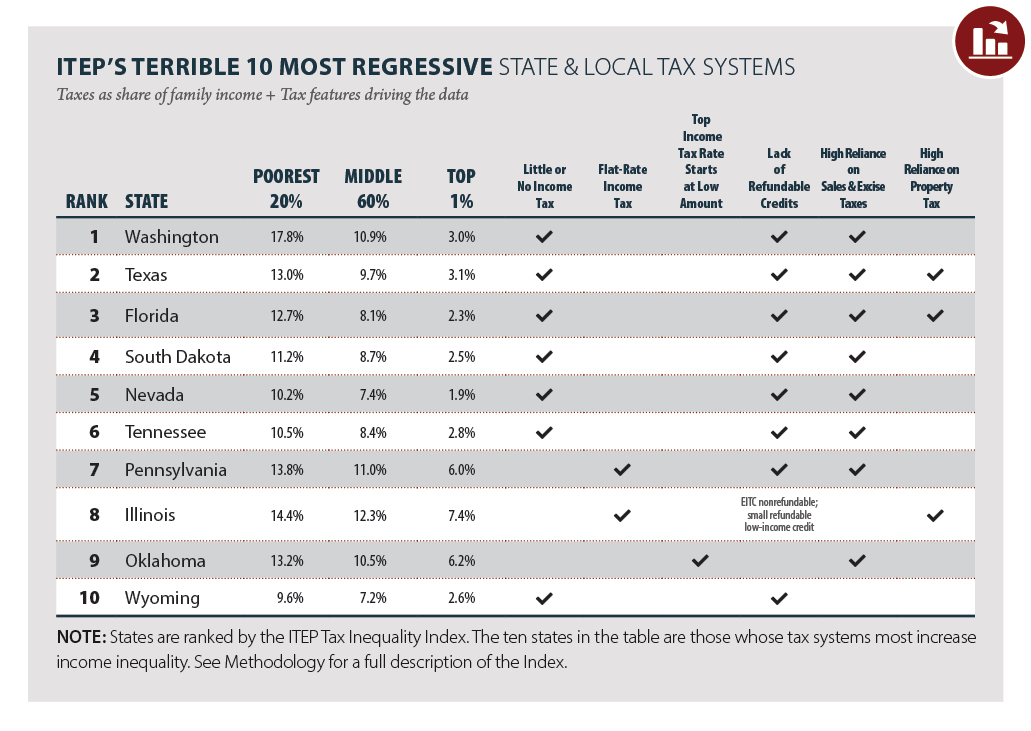

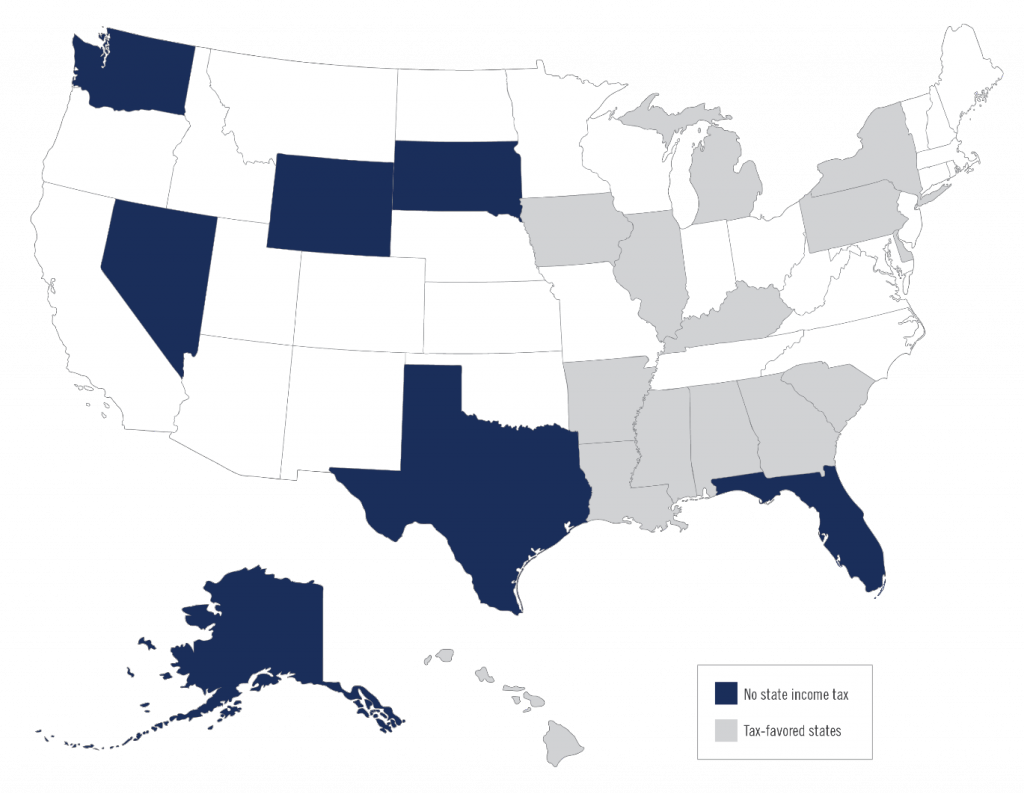

Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state income taxes at all. Ad Get this guide and learn 7 investing strategies to help you generate retirement income.

Relocating To A Tax Favorable State For Retirement Is It Worth It Cain Watters Blog

Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level.

. Eight states have no state income tax. What taxes do retirees pay in Nevada. Those eight Alaska Florida Nevada South.

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas. If youre at least 59½ years old the Magnolia State wont tax your retirement income. For many people who are considering a financially-based move from California to Nevada an adequate understanding of how tax structures can affect them is important to their.

To figure out your provisional income begin with your adjusted gross income and then add 50 of your Social Security benefit and all of your tax-exempt interest. Additionally the average effective. If your provisional income is less than 25000 for individual filers or 32000 for joint filers you wont have to pay taxes on your Social Security.

This includes income from both Social Security and retirement accounts. The EPC contribution rate for regular members is 2800 of gross salary and the rate for policefire members is 4050 of gross salary. However if your provisional income falls between 25000 and 34000 for individual filers or 32000 and 44000 for joint filers.

Additionally the average effective property. We currently live in upstate New York so snow isnt a big. Does that include retirement income from Social Security and pensions.

This includes income from both Social Security and retirement accounts. I see that Nevada has no income tax. Starting in 2022 all military retirees may exclude 50 percent of their.

Nevada sales tax is less than in California. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level. However the state will take its share of 401k IRA or pension income received by those.

Now that you have a good baseline knowledge of how retirement taxes work at the state level lets dive into the states that wont tax you at all. 800-742-7474 or Nebraska Tax Department. Nevada does not tax retirees accounts or pensions.

Military retirees can elect either a 40 percent exclusion of military retirement income for seven consecutive tax years or a 15 percent exclusion for all tax years beginning at age 67. Fisher Investments shares these 7 retirement income strategies to help you in retirement. Under the EmployeeEmployer Paid contribution plan the employee and the employer share equally in the contribution to PERS which is.

5 tax on interest dividends. States That Dont Tax Retirement Income. Nevada does not tax retirees accounts or pensions.

What taxes do retirees pay in Nevada. We were considering Tennessee but now Im thinking about Nevada to be closer to family in California.

Military Retirement And State Income Tax Military Com

The 10 Best U S Cities For An Early Retirement

Nawbo Southern Nevada The Salvation Army Presents Dine And Discover Wealth Management Estate Planning Seminar Presenters Craig Stone Estate And Business Attorney Greg Bodine Senior Gift Estate Planner The Salvation

All The States That Don T Tax Retirement Income

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

12 States That Won T Tax Your Retirement Income Kiplinger

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

The States That Won T Tax Your Fed Retirement Income

Nevada Vs California Taxes Explained Retirebetternow Com

Financial Benefits Of Moving To Nevada Mariner Wealth Advisors

Nevada Estate Tax Everything You Need To Know Smartasset

5 Good Reasons To Retire In Nevada

Arizona Vs Nevada Which State Is More Retirement Friendly

Nevada Tax Advantages And Benefits Retirebetternow Com

7 States Without Income Tax And What You Need To Know Thestreet